Overview

President Biden’s American Rescue Plan made the 2021 Child Tax Credit (CTC) more generous and easier to get for most families. The CTC has increased to $300 per month per child under age 6 and $250 per month for each child age 6 to 17. That’s $3,000 to $3,600 per child in untaxed money.

Most will receive the CTC automatically by mailed check or direct deposit. Through December 15th, this money will be pre-paid to families. After December, the rest of the CTC will be dispersed at tax time.

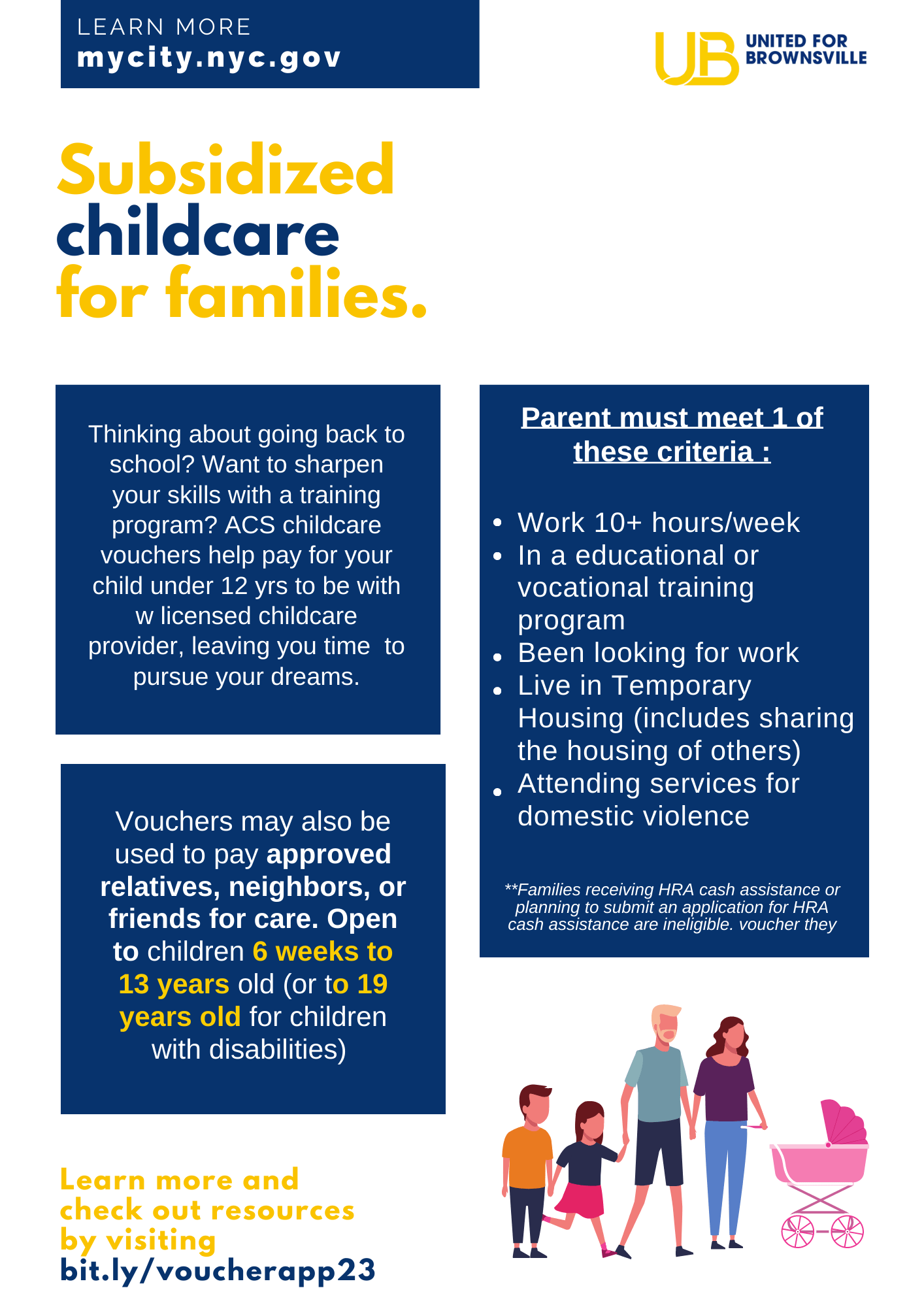

Eligibility

All households with children under 18 are eligible to receive this free money, even if they have no income, receive public benefits, or are not citizens. The CTC will not increase your taxes (for most Americans) or make you ineligible for benefits.

Sign up

If you haven’t received the CTC or have not filed your 2020 tax returns, click here to access an easy sign up tool. Doing this by November 15 will help you get your CTC prepaid along with any 2021 stimulus checks you may have missed.

It sounds almost too good to be true, and we recognize that many will need help or have questions. If you are in Brooklyn, NY, schedule a free appointment with nonprofit tax preparers at Grow Brooklyn, or call Donna at (929) 252-9286 for help signing up.

Frequently Asked Questions

UB recommends the FAQ at TaxOutreach.org for its comprehensive list of questions related to the CTC. For personalized advice we recommend making an appointment with a tax professional, including the folks at Grow Brooklyn.

Thank you Evelyn